LITHUIM SOURCING STRATEGY AT ROSS SCHOOL

lithium extraction

to satisfy industries' demand

lithium extraction

to satisfy industries' demand

EXECUTIVE SUMMARY

The global lithium industry has changed dramatically over the last decade as we continue to see

increases in the electric vehicle and energy storage sectors. The annual consumption is expected

to shoot up by three to four million metric tons in 2030 and therefore, there should be enough

supply to meet the demand, which is expected to grow over 300 percent from 2021 to 2030.

Therefore one of the significant priorities is to identify more opportunities for lithium extraction

to satisfy industries’ demand.

Commercial lithium extraction technology currently relies on two primary sources- salt-flat

brines, and mineral ores. Salt-flat brines are an uncomplicated process, but it takes a lot of

time. Here, firstly the salt-rich water is pumped out into an evaporation pond, where water

slowly evaporates leaving a variety of salts to precipitate out, leaving the pond with lithium

concentration. Moving forward, the slurry of hydrated lime is added to the pond or brine to

remove unwanted elements, majorly magnesium and boron. When lithium concentration fills the

brine, it is pumped to a recovery facility where brine purification, chemical treatments, filtration,

and finally treatment with soda ash are performed to precipitate lithium carbonate. In the

denouement, washing and drying of lithium carbonate are done to finally make it available for

commercial use.

Another process, mineral ore is a significantly more cumbersome and energy intensive process,

where after the ore is mined, crushed, and roasted are at high temperature. Then it is cooled,

miled and roasted again with sulphuric acid. This step replaces hydrogen in sulphuric acid with

lithium, producing lithium sulfate and an insolvent residue.

According to U.S. Geological Survey, and Mineral Commodity, other lithium extraction

methods, such as direct lithium extraction (DLE) from geothermal and oil well brine, are being

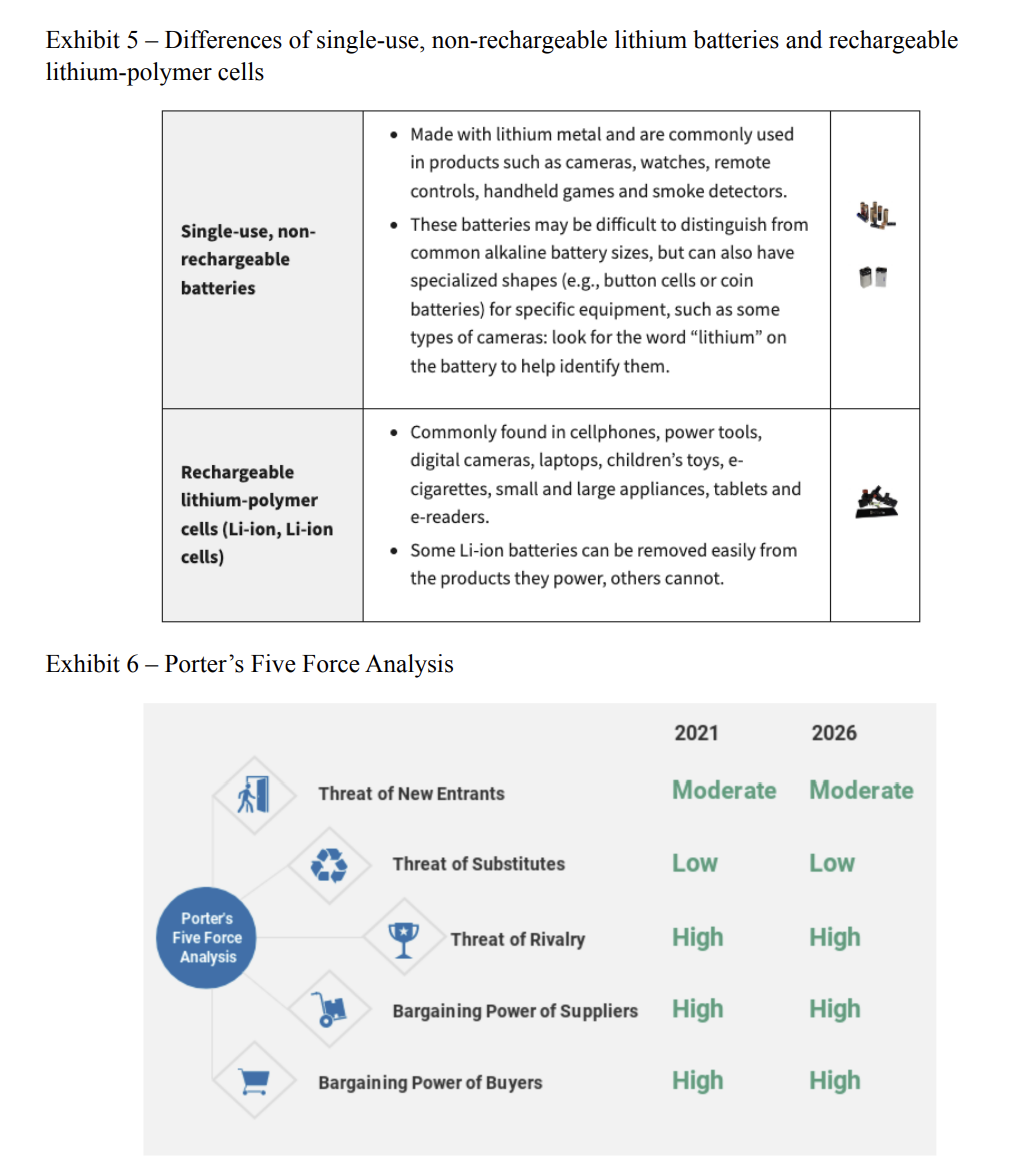

researched at the moment for ascending global production. Now the end product of extraction

technology is mostly lithium carbonate however we do have other end products such as lithium

hydroxide, lithium chloride, and all others are mentioned in Exhibit 1.

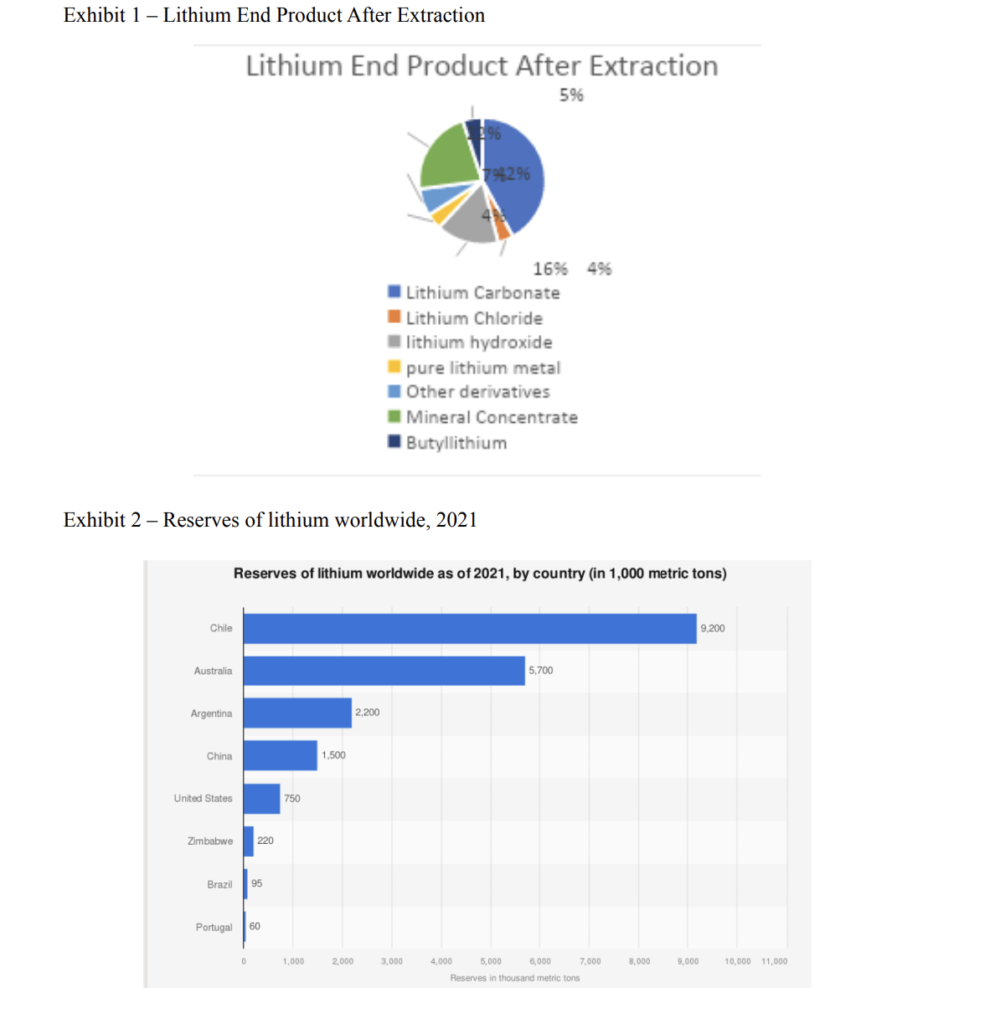

At the moment, almost all lithium mining takes place in Australia, Latin America, and China.

However, pipelines of manifold projects will bring in new players for the lithium mining map,

including Western and Eastern Europe, Russia, and other Commonwealth of Independent States

Members. Additional lithium sources are expected to come from early-stage conventional brine

projects to bridge the supply gap. In the meantime, new technologies like DLE and Direct

Lithium to Product are expected to improve recovery and capacity and the use of direct shipping

ore (DSO) could help mitigate short-term supply risk.

Promising DLE technology is currently being considered not only by unconventional players but

also by traditional players too. The major benefits it provides are to eliminate the footprint of

environmental ponds, decrease production times, and lower reagent and water usage. For a

breakdown on global lithium reserves, refer to Exhibit 2.

ABOUT

Demand Surge

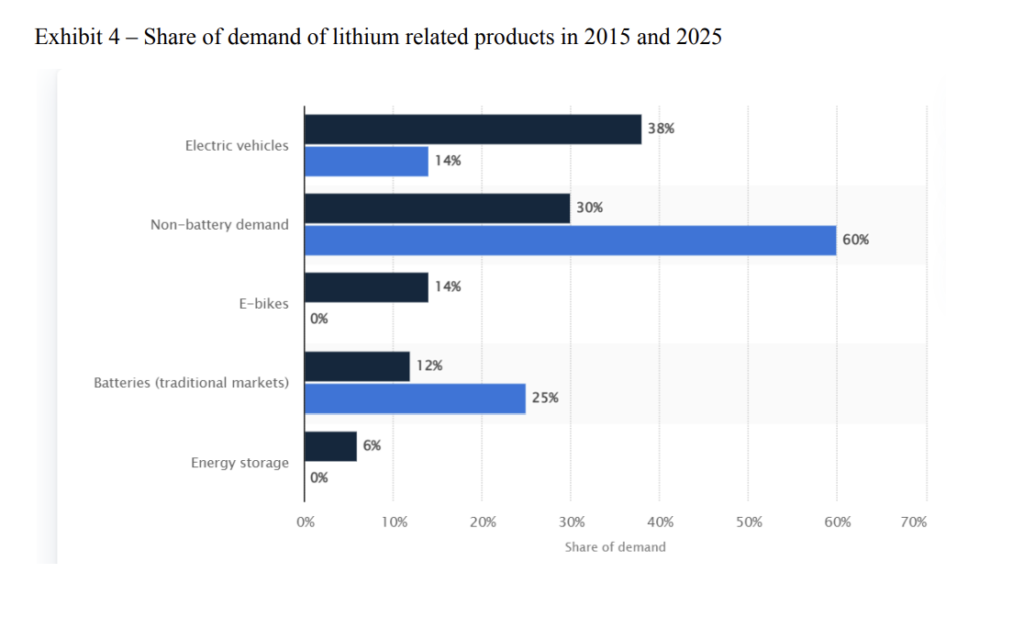

Although electric vehicles are a more sustainable mode of transportation than their

gasoline-guzzling counterparts, their production still consumes a significant amount of Earth’s

resources. With EV production increasing at a rapid pace, this peak will have to be easily

surpassed in the coming years. The demand for lithium carbonate is expected to be 636,000

metric tons in 2022 (Exhibit 3). EVs are expected to be the primary drivers of lithium demand

at this point.

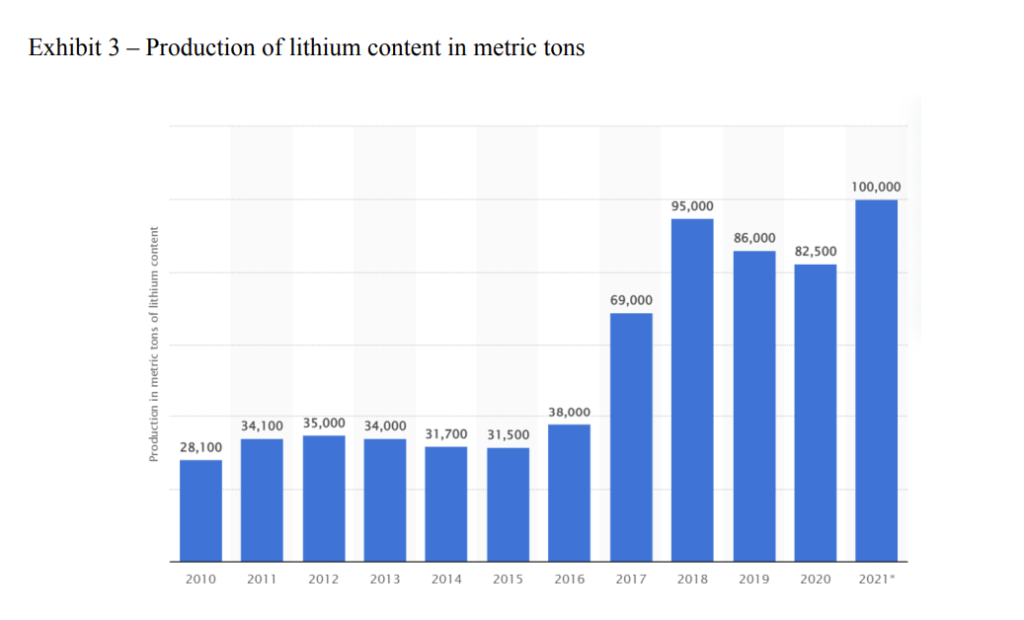

Lithium demand is not limited to automobile industries rather it has an application in consumer

electronics, grid storage, and glass & ceramics. Lithium-ion batteries are widely used in

consumer electronics due to their rechargeability. Furthermore, lithium-ion battery packs have a

higher energy density and provide more power than other battery types. These factors are

increasing the demand for lithium-ion batteries in consumer electronics. Among various battery

technologies, lithium-ion batteries (LIBs) have attracted significant interest as grid supporting

devices due to their remarkable advantages, namely relatively high energy density. So far, 77%

of electrical power storage systems in the United States that operate to stabilize the grid (e.g.,

primarily for frequency regulation) rely on LIBs, indicating that LIBs have a high-value market.

Furthermore, because of their high energy density, LIBs will be an excellent choice for

integration with renewable energy sources in grid-level energy storage systems, in which LIBs

store generated electrical energy for use at a low cost by end users when needed. In glass and

ceramics, Lithium increases ceramic body strength, improving durability. It also ensures color

consistency and increases melt rate and lowers viscosity. Exhibit 4 compares the

department-wise distribution of consumption of lithium in 2015 and 2025.

Vel fringilla est ullamcorper eget nulla facilisi etiama ashfa dignissim diam quis enim lobortis scelerisque fermentum dui faucibus in ornare quam viverra orci sagittis eu agv he volutpat odio asas facilisis mauris sit.

Year

2022

Client

Ross School

Services

Project

Project

Sourcing

Description

Strategic response to supply constraints and price rises

One of the strategic solutions that EV manufacturers have identified is to invest in battery metals

such as lithium themselves to guarantee a reliable supply chain that meets their expansion goals.

There has been an increase in the number of battery-metals mining investments by carmakers to

secure enough battery metals. A total of 21 such investments were made over the past 18 months

from 2021 to 2022, as compared to just two prior to 2021. Of those projects, 16 were investments

into lithium mining and the rest were towards nickel. The lithium mining investment projects

included a supply deal between China’s Ganfeng Lithium Co. and Tesla in November 2021 and a

BMW Group investment in Lilac Solutions, which provides technology for sustainable lithium

extraction